To develop a finance career, it has become almost a necessity to earn a relevant degree or credential for requisite knowledge and skills, which can be useful in a specialized area of finance. There are some certification programs available for students, entry-level professionals, and experienced professionals, designed to develop and validate specific capabilities for finance professionals’ benefit. CFA and ACCA are two such specialized certification programs of international repute. One one side CFA is all about Investment Management, ACCA is more into detailed accounting and auditing.

What is CFA?

Chartered Financial Analysts (CFA) Institute offers one of the most competitive financial credentials, widely considered the “gold standard” of financial analysis and investment management. It is undoubtedly one of the most rigorous certification programs in finance, which covers several key knowledge areas in finance, making it the best fit for those interested in developing a career as a financial analyst or in the field of investment banking.

Although an MBA in Finance from one of the top institutes could be the preferred credentials for top investment banks, CFA Charter comes in a close second.

What is ACCA?

It is a highly valued credential offered by a global body for professional accountants, the Association of Chartered Certified Accountants (ACCA), to help build key accounting skills and validate aspiring finance professionals’ capabilities.

This is a multi-tier certification program primarily focused on knowledge areas related to accountancy, taxation, and auditing. Though not on the same level as CFA in terms of reputation, it is a widely recognized credential that can significantly help students or accounting professionals boost their career prospects.

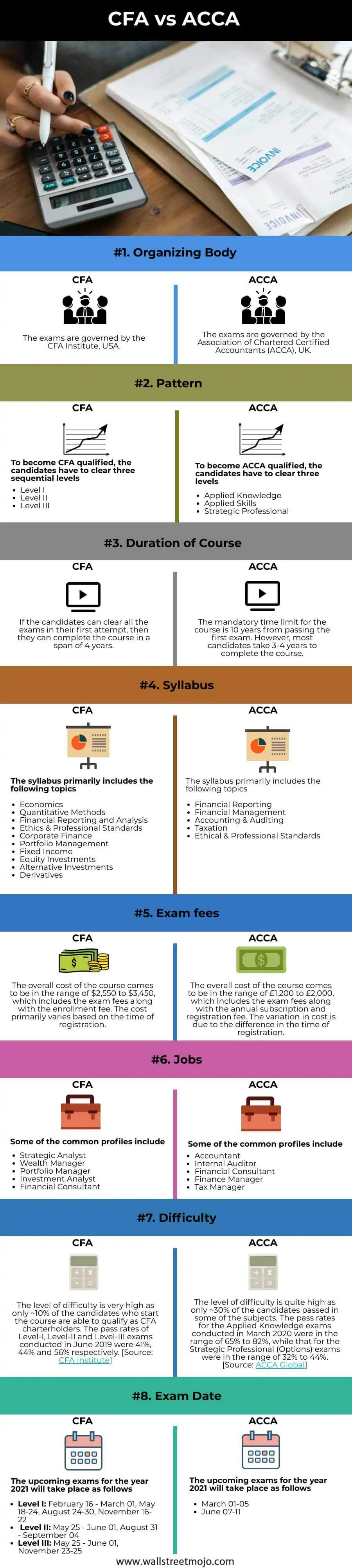

CFA vs. ACCA Infographics

You are free to use this image on your website, templates etc, Please provide us with an attribution link

CFA and ACCA Entry Requirements

- For CFA You Need: To qualify for CFA, a candidate should have a Bachelor’s Degree (or they should be in the final year of Bachelor’s Degree) or 4 years of professional work experience or 4 years of higher education professional work experience taken together.

- For ACCA You Need: To qualify for ACCA, one must have completed 10+2 from commerce stream, students pursuing graduation in commerce, and those who have completed BA or B.Sc. with Foundation in Accountancy can qualify.

CFA vs. ACCA Comparative Table

| Section | CFA | ACCA | |

| Organizing Body | The exams are governed by the CFA Institute, USA. | The exams are governed by the Association of Chartered Certified Accountants (ACCA), UK. | |

| Pattern | To become CFA qualified, the candidates have to clear three sequential levels Level I Level II Level III | To become ACCA qualified, the candidates have to clear three levels of Applied Knowledge Applied Skills Strategic Professional | |

| Duration of Course | If the candidates can clear all the exams in their first attempt, then they can complete the course in a span of 4 years. | The mandatory time limit for the course is 10 years from passing the first exam. However, most candidates take 3-4 years to complete the course. | |

| Syllabus | The syllabus primarily includes the following topics Economics Quantitative Methods Financial Reporting and Analysis Ethics & Professional Standards Corporate Finance Portfolio Management Fixed Income Equity Investments Alternative Investments Derivatives | The syllabus primarily includes the following topics Financial Reporting Financial Management Accounting & Auditing Taxation Ethical & Professional Standards | |

| Exam Fees | The overall cost of the course comes to be in the range of $2,550 to $3,450, which includes the exam fees along with the enrollment fee. The cost primarily varies based on the time of registration. | The overall cost of the course comes to be in the range of £1,200 to £2,000, which includes the exam fees along with the annual subscription and registration fee. The variation in cost is due to the difference in the time of registration. | |

| Jobs | Some of the common profiles include Strategic Analyst Wealth Manager Portfolio Manager Investment Analyst Financial Consultant | Some of the common profiles include Accountant Internal Auditor Financial Consultant Finance Manager Tax Manager | |

| Difficulty | The level of difficulty is very high as only ~10% of the candidates who start the course are able to qualify as CFA charterholders. The pass rates of Level-I, Level-II, and Level-III exams conducted in June 2019 were 41%, 44%, and 56% respectively. | The level of difficulty is quite high as only ~30% of the candidates passed in some of the subjects. The pass rates for the Applied Knowledge exams conducted in March 2020 were in the range of 65% to 82%, while that for the Strategic Professional (Options) exams were in the range of 32% to 44%. | |

| Exam Date | The upcoming exams for the year 2026 will take place as follows Level I: February 16 – March 01, May 18-24, August 24-30, November 16-22 Level II: May 25 – June 01, August 31 – September 04 Level III: May 25 – June 01, November 23-25 | The upcoming exams for the year 2026 will take place as follows March 01-05 June 07-11 |

Why Pursue CFA?

Finance professionals involved in equity research, financial modeling, investment management, and other areas can benefit greatly by earning CFA Charter. It can help enhance career prospects by equipping them with expert knowledge of complex finance areas and adding to their credibility in the eyes of industry-leading employers.

For non-investment professionals, it can prove to be of great advantage as a valued credential, which brings a lot of respectability and opens up new avenues of growth.

Why Pursue ACCA?

Partnering with more than 8,500 employers worldwide, ACCA opens up global work opportunities for students and professionals. Students and finance professionals interested in acquiring specialized knowledge of finance and accounting can opt for ACCA.

Entry requirements are not as stringent as well. Its course curriculum covers accounting, taxation, auditing, and several other critical areas, including law, business studies, financial management, financial reporting, and professional and ethical standards.

Conclusion

CFA is a highly specialized credential, suited for finance professionals seeking to develop expert capabilities in areas related to financial analysis and equity research. However, ACCA is a broad-based accounting certification and a better fit for students or professionals looking to advance their prospects as accounting or auditing professionals.

Both of the credentials are globally acknowledged, but CFA is miles ahead of ACCA regarding its quality and value as a professional credential. CFA Charter is much more difficult to attain as compared to ACCA Qualification, but it can be worth it.

However, CFA is more suited for experienced finance professionals looking to specialize in a certain area. In contrast, ACCA is best for entry-or mid-level professionals looking to widen their career horizons while acquiring useful accounting and auditing skills.

Need Information or Confused about Something ?

Ask a Question

Sponsored Guide

Complete Guide to NSFAS Online Loan Application for South African Students (2025)

If you are a South African student looking to pursue higher education but are facing financial difficulties, the National Student Financial Aid Scheme (NSFAS) is one of the most accessible funding options available. NSFAS provides financial aid in the form of bursaries and loans to qualifying students at public universities and TVET colleges in South Africa.

This guide will walk you through everything you need to know about the NSFAS loan application process, from eligibility requirements to application steps and frequently asked questions.

📌 What is NSFAS?

The National Student Financial Aid Scheme (NSFAS) is a government-funded financial aid scheme aimed at helping students from low- and middle-income households to access tertiary education without the burden of upfront fees.

NSFAS offers both bursaries and income-contingent loans:

- Bursaries: For eligible students who meet academic and household income criteria (especially for TVET and university students).

- Loans: For students who do not meet all bursary criteria or who are pursuing postgraduate qualifications not funded under bursary schemes.

✅ Who Qualifies for an NSFAS Loan?

To qualify for an NSFAS loan (especially for postgraduate students or programs not funded under the bursary system), you must:

- Be a South African citizen.

- Be financially needy, with a household income of less than R350,000 per year.

- Have a valid South African ID.

- Be enrolled or accepted to study at a public university or TVET college.

- Not be funded through another bursary program that covers all expenses.

- Maintain satisfactory academic progress (returning students).

📚 Courses Funded by NSFAS

NSFAS primarily funds undergraduate qualifications, but certain postgraduate programs (e.g., PGCE, postgraduate diplomas in education, and professional courses like LLB) may be considered under the NSFAS loan scheme, not bursaries.

If you’re studying:

- Undergraduate degree or diploma: You are likely eligible for a full NSFAS bursary.

- Postgraduate study: You may qualify for a loan, depending on the course and funding availability.

📄 Required Documents for NSFAS Application

When applying, make sure you have the following documents scanned and ready:

- Certified copy of your South African ID or Smart Card.

- Parent(s) or guardian(s) ID documents.

- Proof of income (latest payslips, UIF, or affidavit if unemployed).

- Consent Form signed by your parent(s)/guardian(s) to allow NSFAS to verify income.

- Proof of registration or acceptance at a public institution.

- Academic transcripts (for continuing or postgraduate students).

🖥️ How to Apply for an NSFAS Loan Online

Step-by-Step NSFAS Online Application Process (2025)

-

Visit the NSFAS Website

Go to: https://www.nsfas.org.za

-

Create an Account

- Click on “MyNSFAS” and register your profile.

- You’ll need a valid email address and South African cellphone number.

- Choose a strong password and verify your account via email or SMS.

-

Login and Start the Application

- After registration, log in to your MyNSFAS account.

- Click on “Apply” to begin a new application.

-

Fill in Your Personal Details

- Input your ID number, name, surname, and other details exactly as they appear on your ID.

- Provide household income information and living arrangements.

-

Upload Required Documents

- Upload all supporting documents in PDF or JPEG format.

- Each document must be clear and under the size limit specified.

-

Submit Your Application

- Review your application for accuracy.

- Click “Submit” and wait for a confirmation message.

-

Track Your Application

- Log in regularly to check your application status.

- You will be notified via SMS and email at each stage of the process.

🗓️ Important NSFAS Dates (2025)

- Application Opening Date: September 1, 2025

- Application Deadline: January 31, 2026

- Appeals Period: February 2026 (if rejected)

- Disbursement: After registration and approval

Note: Dates are subject to change; always confirm on the official NSFAS website.

💸 What Does the NSFAS Loan Cover?

NSFAS funding typically includes:

- Tuition fees

- Registration fees

- Accommodation (if living away from home)

- Meals and transport

- Learning materials (e.g., textbooks)

For loans, repayment is only required once you start working and earn above a threshold (around R30,000 annually, but subject to change).

🔄 NSFAS Loan Repayment

Repayments are:

- Income-contingent – you only repay when you can afford to.

- Administered by DHET (Department of Higher Education and Training).

- Interest-bearing, but interest rates are low and favorable.

You can also apply for a partial loan conversion to a bursary if you perform well academically.

🔁 How to Appeal a Rejected NSFAS Application

If your application is rejected, you may submit an appeal via your MyNSFAS portal:

- Log into your MyNSFAS account.

- Click on “Track Funding Progress”.

- If rejected, click on “Submit Appeal”.

- Upload any missing or corrected documents.

- Provide a clear explanation or motivation.

📱 NSFAS Contact Information

- Website: https://www.nsfas.org.za

- Email: info@nsfas.org.za

- Toll-Free Number: 08000 67327 (Monday–Friday, 8 AM–5 PM)

- Twitter: @myNSFAS

- Facebook: NSFAS

📝 Final Tips Before Applying

- Apply early to avoid system overload near the deadline.

- Use your own email and cellphone number (do not use someone else’s).

- Double-check that all your documents are certified and legible.

- Keep a copy of your submission confirmation for reference.

By following this guide, you can confidently apply for NSFAS funding and move one step closer to achieving your academic and career dreams—without the burden of immediate financial pressure.