| EPF balance check Through SMS | Send a SMS to 7738299899 |

| EPF balance check Through Missed Call | Give a miss call on 011-22901406 |

| EPF balance check Through EPFO Portal | Login to www.epfindia.gov.in |

| EPF balance check Through Mobile App | Download UMANG App |

- To check your EPF balance, you must have an activated UAN number.

- PF balance check is available for current as well as previous organisations.

- It usually takes 24 hours for EPF balance to get updated.

- Login with activated UAN number to check EPF balance at EPFO portal.

I. Using Umang app

Employees can view their PF balance on mobile phones with the help of Umang app. Umang app was launched by the government to provide access to various government services in a single place. One can view EPF Passbook, raise claim and even track Claim using the app. To get started, you need to complete a one-time registration using your phone number.

PF Balance Check Using EPFO Portal

Important Note: To check EPF balance, make sure that the employer has activated your Universal Account Number (UAN). Universal Account Number or UAN is unique for all the employees enrolled under the EPF scheme. A UAN number is allotted by the Employee Provident Fund Organization (EPFO). All employees should have only one UAN during their working life irrespective of the companies they change. Once your UAN number is activated, just follow these steps:

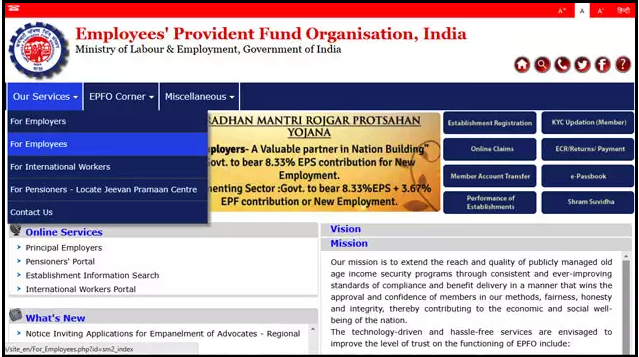

Step 1: Log on to the EPFO portal. Go to the tab ‘Our Services’ and choose the option that says “for employees” from the drop-down menu.

Step 2: Now, click on the option ‘Member passbook’ under the option “Services.”

Step 3: A login page will appear. Enter your UAN number and password here after it has been activated.

After logging in, you can access your EPF account.

2.PF Balance Check by Sending an SMS

Important Note: It is essential to integrate your UAN number with your KYC details, i.e. Aadhar or PAN or bank account details. Only then can you be eligible to access your EPF balance via SMS.

Once the UAN number is integrated with your KYC details, follow these steps:

Step 1: Send an SMS to mobile number 7738299899.

Step 2: You need to send the message as EPFOHO UAN ENG.

You’ll need to set your preferred language of communication. You can do that by using the first three characters of your preferred language. If you wish to receive updates in English, use the first three characters of the word English like EPFOHO UAN ENG – where ENG stands for English. If you want to receive the message updates in Marathi, then type in EPFOHO UAN MAR – where MAR stands for Marathi. This facility is available in English, Hindi, Punjabi, Gujarati, Marathi, Kannada, Telugu, Tamil, Malayalam, and Bengali.

3. PF Balance Check by giving a missed call

Important Note: You can inquire about your EPF balance by giving a missed call to the authorised phone from your registered mobile number. This service is only available upon the integration of your UAN with your KYC details. If you are unable to do this, you can take the help of your employer. Once the UAN is integrated with your KYC details, follow the steps mentioned below:

Step 1: Give a missed call to 011-22901406 from your registered mobile number.

Step 2: After placing a missed call, you will receive an SMS providing you with your PF details.

4. PF Balance Check using the Umang/EPFO app

Important Note: To check your PF balance, make sure that the employer has activated your UAN number. You can also check your PF balance by downloading the “m-sewa app of EPFO” from the Google Play Store.

Step 1: Once the app is downloaded, click on ‘Member’ and then go to ‘Balance/Passbook’.

Step 2: Afterwards, enter your UAN and registered mobile number. The system will verify your mobile number against your UAN. If all the details check out, you can view your updated EPF balance details. In case of a mismatch, it will display an error.

Recently, the Electronics and IT Ministry has launched an app called “Umang.” Umang helps merges different government services like Aadhaar, gas booking, crop insurance, NPS, and EPF. You can also use this app to check your PF details. Upon installation, you can find the EPFO option from the app’s homepage under the head “Employee Centric Services” option and access your PF account details. The app can be downloaded from Google Play Store.

Need Information or Confused about Something ?

Ask a Question

Sponsored Guide

Complete Guide to NSFAS Online Loan Application for South African Students (2025)

If you are a South African student looking to pursue higher education but are facing financial difficulties, the National Student Financial Aid Scheme (NSFAS) is one of the most accessible funding options available. NSFAS provides financial aid in the form of bursaries and loans to qualifying students at public universities and TVET colleges in South Africa.

This guide will walk you through everything you need to know about the NSFAS loan application process, from eligibility requirements to application steps and frequently asked questions.

📌 What is NSFAS?

The National Student Financial Aid Scheme (NSFAS) is a government-funded financial aid scheme aimed at helping students from low- and middle-income households to access tertiary education without the burden of upfront fees.

NSFAS offers both bursaries and income-contingent loans:

- Bursaries: For eligible students who meet academic and household income criteria (especially for TVET and university students).

- Loans: For students who do not meet all bursary criteria or who are pursuing postgraduate qualifications not funded under bursary schemes.

✅ Who Qualifies for an NSFAS Loan?

To qualify for an NSFAS loan (especially for postgraduate students or programs not funded under the bursary system), you must:

- Be a South African citizen.

- Be financially needy, with a household income of less than R350,000 per year.

- Have a valid South African ID.

- Be enrolled or accepted to study at a public university or TVET college.

- Not be funded through another bursary program that covers all expenses.

- Maintain satisfactory academic progress (returning students).

📚 Courses Funded by NSFAS

NSFAS primarily funds undergraduate qualifications, but certain postgraduate programs (e.g., PGCE, postgraduate diplomas in education, and professional courses like LLB) may be considered under the NSFAS loan scheme, not bursaries.

If you’re studying:

- Undergraduate degree or diploma: You are likely eligible for a full NSFAS bursary.

- Postgraduate study: You may qualify for a loan, depending on the course and funding availability.

📄 Required Documents for NSFAS Application

When applying, make sure you have the following documents scanned and ready:

- Certified copy of your South African ID or Smart Card.

- Parent(s) or guardian(s) ID documents.

- Proof of income (latest payslips, UIF, or affidavit if unemployed).

- Consent Form signed by your parent(s)/guardian(s) to allow NSFAS to verify income.

- Proof of registration or acceptance at a public institution.

- Academic transcripts (for continuing or postgraduate students).

🖥️ How to Apply for an NSFAS Loan Online

Step-by-Step NSFAS Online Application Process (2025)

-

Visit the NSFAS Website

Go to: https://www.nsfas.org.za

-

Create an Account

- Click on “MyNSFAS” and register your profile.

- You’ll need a valid email address and South African cellphone number.

- Choose a strong password and verify your account via email or SMS.

-

Login and Start the Application

- After registration, log in to your MyNSFAS account.

- Click on “Apply” to begin a new application.

-

Fill in Your Personal Details

- Input your ID number, name, surname, and other details exactly as they appear on your ID.

- Provide household income information and living arrangements.

-

Upload Required Documents

- Upload all supporting documents in PDF or JPEG format.

- Each document must be clear and under the size limit specified.

-

Submit Your Application

- Review your application for accuracy.

- Click “Submit” and wait for a confirmation message.

-

Track Your Application

- Log in regularly to check your application status.

- You will be notified via SMS and email at each stage of the process.

🗓️ Important NSFAS Dates (2025)

- Application Opening Date: September 1, 2025

- Application Deadline: January 31, 2026

- Appeals Period: February 2026 (if rejected)

- Disbursement: After registration and approval

Note: Dates are subject to change; always confirm on the official NSFAS website.

💸 What Does the NSFAS Loan Cover?

NSFAS funding typically includes:

- Tuition fees

- Registration fees

- Accommodation (if living away from home)

- Meals and transport

- Learning materials (e.g., textbooks)

For loans, repayment is only required once you start working and earn above a threshold (around R30,000 annually, but subject to change).

🔄 NSFAS Loan Repayment

Repayments are:

- Income-contingent – you only repay when you can afford to.

- Administered by DHET (Department of Higher Education and Training).

- Interest-bearing, but interest rates are low and favorable.

You can also apply for a partial loan conversion to a bursary if you perform well academically.

🔁 How to Appeal a Rejected NSFAS Application

If your application is rejected, you may submit an appeal via your MyNSFAS portal:

- Log into your MyNSFAS account.

- Click on “Track Funding Progress”.

- If rejected, click on “Submit Appeal”.

- Upload any missing or corrected documents.

- Provide a clear explanation or motivation.

📱 NSFAS Contact Information

- Website: https://www.nsfas.org.za

- Email: info@nsfas.org.za

- Toll-Free Number: 08000 67327 (Monday–Friday, 8 AM–5 PM)

- Twitter: @myNSFAS

- Facebook: NSFAS

📝 Final Tips Before Applying

- Apply early to avoid system overload near the deadline.

- Use your own email and cellphone number (do not use someone else’s).

- Double-check that all your documents are certified and legible.

- Keep a copy of your submission confirmation for reference.

By following this guide, you can confidently apply for NSFAS funding and move one step closer to achieving your academic and career dreams—without the burden of immediate financial pressure.