The HPCSA is responsible for regulating health professionals in South Africa to ensure they meet specific qualifications, abide by ethical practices, and offer safe services to the public. One crucial area is psychological assessments, which must only be conducted by professionals who are registered with the HPCSA.

It is illegal for unregistered individuals to perform psychological tests. Therefore, if you’ve been assessed by a psychologist, psychometrist, or registered counselor, it’s important to verify their registration status to ensure they are qualified.

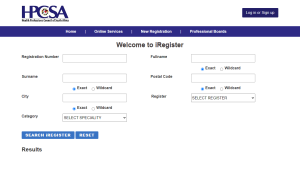

What is HPCSA iRegister?

The HPCSA iRegister is an online tool available to the public that allows you to search the council’s database to verify if a health practitioner is registered. This system provides easy access to health professionals’ registration status, ensuring transparency and trust between practitioners and the public.

What You Need to Check Registration on HPCSA iRegister

To perform a check, you need some basic details about the person you’re investigating. These details include:

- Their surname

- Their full names (if available)

- Their HPCSA registration number (if known)

- The specific register they should be listed under, such as psychologists, psychometrists, or registered counsellors.

Having this information ensures you can pinpoint the right professional.

How to Use the HPCSA iRegister System

Here’s a step-by-step guide to checking whether a professional is registered with the HPCSA:

- Visit the HPCSA Website

Go to the official website of the Health Professions Council of South Africa at www.hpcsa.co.za. - Access the iRegister Portal

On the homepage, you will find a section labeled “Access to the iRegister.” Click on it to be redirected to the iRegister query interface. - Enter the Required Information

Once you’re in the iRegister section, you will see several options where you can enter the details you have. You can input:- The professional’s surname (with options for “exact” or “wildcard” search)

- Their full name (a “wildcard” search may be helpful as people often use abbreviations or variations of their full name)

- The registration number (if available)

- The specific register (psychologists, psychometrists, or registered counsellors)

- Search

After entering the details, the system will filter through the registered professionals and display a list of matches. - View the Results

Once the search results are shown, you can click on “view” to see more details about the person. This will show you whether their registration is active, erased, or suspended. - Check Registration Status

When viewing the details page, make sure to verify if the person’s registration status is active. If the status is listed as erased or suspended, the individual is not allowed to practice or conduct psychological assessments.

What to Do if the Professional is Not Registered

If you cannot find the person listed on the register or if their registration status is inactive, there are a few next steps you can take:

Need Information or Confused about Something ?

Ask a Question- Ask the practitioner directly: They may be able to provide additional information or clarify any discrepancies.

- Contact the HPCSA: You can call or email the HPCSA for assistance in verifying a practitioner’s status if you are unable to find them on the iRegister.

Why Regularly Checking Registration Matters

For both public health and legal reasons, it is crucial to ensure that the healthcare professionals you interact with are legally permitted to practice. Whether you are seeking psychological assessments or any other healthcare services, the HPCSA iRegister check provides peace of mind that you’re receiving care from qualified individuals. If a professional’s registration is not active, they are not allowed to perform certain duties, and it could be a red flag that may require further investigation.

Sponsored Guide

Complete Guide to NSFAS Online Loan Application for South African Students (2025)

If you are a South African student looking to pursue higher education but are facing financial difficulties, the National Student Financial Aid Scheme (NSFAS) is one of the most accessible funding options available. NSFAS provides financial aid in the form of bursaries and loans to qualifying students at public universities and TVET colleges in South Africa.

This guide will walk you through everything you need to know about the NSFAS loan application process, from eligibility requirements to application steps and frequently asked questions.

📌 What is NSFAS?

The National Student Financial Aid Scheme (NSFAS) is a government-funded financial aid scheme aimed at helping students from low- and middle-income households to access tertiary education without the burden of upfront fees.

NSFAS offers both bursaries and income-contingent loans:

- Bursaries: For eligible students who meet academic and household income criteria (especially for TVET and university students).

- Loans: For students who do not meet all bursary criteria or who are pursuing postgraduate qualifications not funded under bursary schemes.

✅ Who Qualifies for an NSFAS Loan?

To qualify for an NSFAS loan (especially for postgraduate students or programs not funded under the bursary system), you must:

- Be a South African citizen.

- Be financially needy, with a household income of less than R350,000 per year.

- Have a valid South African ID.

- Be enrolled or accepted to study at a public university or TVET college.

- Not be funded through another bursary program that covers all expenses.

- Maintain satisfactory academic progress (returning students).

📚 Courses Funded by NSFAS

NSFAS primarily funds undergraduate qualifications, but certain postgraduate programs (e.g., PGCE, postgraduate diplomas in education, and professional courses like LLB) may be considered under the NSFAS loan scheme, not bursaries.

If you’re studying:

- Undergraduate degree or diploma: You are likely eligible for a full NSFAS bursary.

- Postgraduate study: You may qualify for a loan, depending on the course and funding availability.

📄 Required Documents for NSFAS Application

When applying, make sure you have the following documents scanned and ready:

- Certified copy of your South African ID or Smart Card.

- Parent(s) or guardian(s) ID documents.

- Proof of income (latest payslips, UIF, or affidavit if unemployed).

- Consent Form signed by your parent(s)/guardian(s) to allow NSFAS to verify income.

- Proof of registration or acceptance at a public institution.

- Academic transcripts (for continuing or postgraduate students).

🖥️ How to Apply for an NSFAS Loan Online

Step-by-Step NSFAS Online Application Process (2025)

-

Visit the NSFAS Website

Go to: https://www.nsfas.org.za

-

Create an Account

- Click on “MyNSFAS” and register your profile.

- You’ll need a valid email address and South African cellphone number.

- Choose a strong password and verify your account via email or SMS.

-

Login and Start the Application

- After registration, log in to your MyNSFAS account.

- Click on “Apply” to begin a new application.

-

Fill in Your Personal Details

- Input your ID number, name, surname, and other details exactly as they appear on your ID.

- Provide household income information and living arrangements.

-

Upload Required Documents

- Upload all supporting documents in PDF or JPEG format.

- Each document must be clear and under the size limit specified.

-

Submit Your Application

- Review your application for accuracy.

- Click “Submit” and wait for a confirmation message.

-

Track Your Application

- Log in regularly to check your application status.

- You will be notified via SMS and email at each stage of the process.

🗓️ Important NSFAS Dates (2025)

- Application Opening Date: September 1, 2025

- Application Deadline: January 31, 2026

- Appeals Period: February 2026 (if rejected)

- Disbursement: After registration and approval

Note: Dates are subject to change; always confirm on the official NSFAS website.

💸 What Does the NSFAS Loan Cover?

NSFAS funding typically includes:

- Tuition fees

- Registration fees

- Accommodation (if living away from home)

- Meals and transport

- Learning materials (e.g., textbooks)

For loans, repayment is only required once you start working and earn above a threshold (around R30,000 annually, but subject to change).

🔄 NSFAS Loan Repayment

Repayments are:

- Income-contingent – you only repay when you can afford to.

- Administered by DHET (Department of Higher Education and Training).

- Interest-bearing, but interest rates are low and favorable.

You can also apply for a partial loan conversion to a bursary if you perform well academically.

🔁 How to Appeal a Rejected NSFAS Application

If your application is rejected, you may submit an appeal via your MyNSFAS portal:

- Log into your MyNSFAS account.

- Click on “Track Funding Progress”.

- If rejected, click on “Submit Appeal”.

- Upload any missing or corrected documents.

- Provide a clear explanation or motivation.

📱 NSFAS Contact Information

- Website: https://www.nsfas.org.za

- Email: info@nsfas.org.za

- Toll-Free Number: 08000 67327 (Monday–Friday, 8 AM–5 PM)

- Twitter: @myNSFAS

- Facebook: NSFAS

📝 Final Tips Before Applying

- Apply early to avoid system overload near the deadline.

- Use your own email and cellphone number (do not use someone else’s).

- Double-check that all your documents are certified and legible.

- Keep a copy of your submission confirmation for reference.

By following this guide, you can confidently apply for NSFAS funding and move one step closer to achieving your academic and career dreams—without the burden of immediate financial pressure.