Construction Industry Development Board. Big words, I know, but all it means Construction companies that are required to be registered to CIDB for numerous types of construction work. That is correct. So if you are an owner of a Construction Company and you are applying for tenders, you need to be registered under the Construction Industry Development Board in order to qualify for the necessary requirements for a tender.

Many times in the Construction Industry, when Municipalities are advertising tenders, one of the requirements are being registered under CIDB.

Alright, now that we know what CIDB is, let us have a look at the CIDB Class of Construction works that fall under CIDB. There are about twenty different Classes of Construction Works. Do not worry…I will not bore you with all the details. I am simply going to list them:

Class of Construction Works:

- GB – General Building

- CE – Civil Engineering

- EB – Electrical Engineering Works – Building

- EP – Electrical Engineering Works – Infrastructure

- ME – Mechanical Engineering

- SB – Asphalt Works (Supply and Lay)

- SC – Building Excavations, shaft sinking, lateral earth ear support

- SD – Corrosion Protection (cathodic, anodic and electrolytic)

- SE – Demolition and Blasting

- SF – Fire prevention and Protective systems

- SG – Glazing, curtain walls and shoplifts

- SH – Landscaping, irrigation and horticulture works

- SI – Lifts, escalators and travellators (installation, commissioning and maintenance)

- SJ – Piling and Specialised foundations for buildings and structures

- SK – Road marking and signage

- SL – Structural steelwork fabrication and erection

- SM – Timber buildings and structures

- SN – Waterproofing of basements, roofs and walls using specialised systems

- SO – Water Supply and drainage for building (wet services, plumbing)

- SQ – Steel security fencing or precast concrete

Now we are going to take a look at the Values of the Rating for CIDB gradings.

Here they are:

CIDB 1: R 0 – R 200.000

CIDB 2: R 200.00 – R 650.00

CIDB 3: R650.00 – R 2 Million

CIDB 4: R 2 Million – R 4 Million

CIDB 5: R 4 Million – R 6.5 Million

CIDB 6: R 6.5 Million – R 13 Million

CIDB 7: R 13 Million – R 40 Million

CIDB 8: R 40 Million – R 130 Million

CIDB 9: R130 Million Plus

Okay, that was quite a mouthful. The Class of Construction works is basically an indication of what your business does.

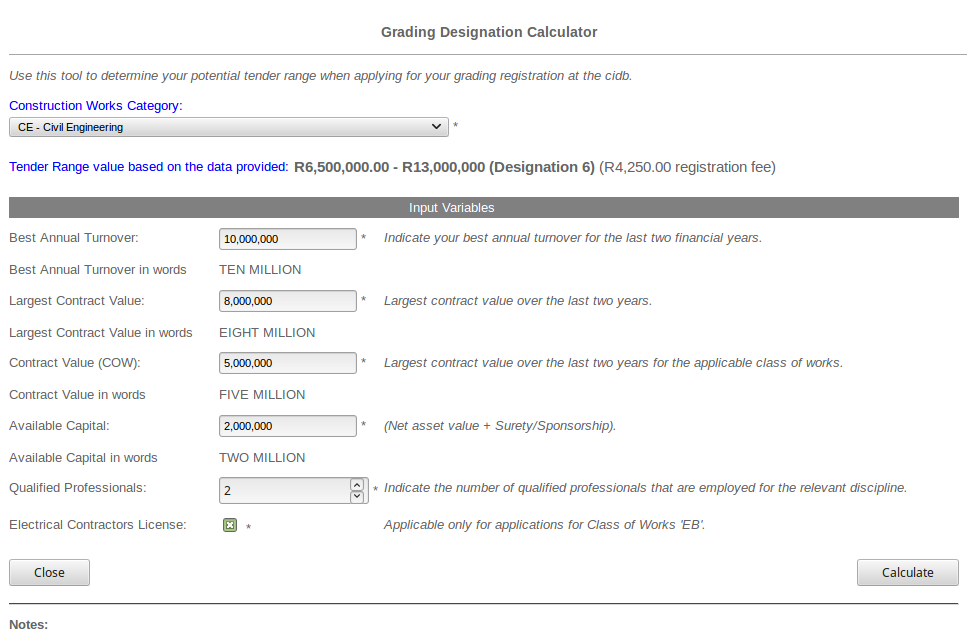

Now we will take a look at how your company determines their grading. This is called the Grading Designation Calculator and can be done on the CIDB Website. All that is required of your business is the financial documents. Well, you are looking at your Profit and Loss for the Financial Year, the largest contract value that was awarded to your company and you will also need the capital value of the business.

Below is an example of a how a Grading Designartion Calculator is done. Trust me, it really simple and just takes a few minutes:

Please note that the CIDB is only for Construction Companies that do Construction work for non–residential areas. That would be your Office Buildings, General Building and Maintenace of government property (Hospitals, Fire Stations, Municipal Buildings, etc).

Construction companies that deal with Residential areas, your company has to be registered under the National Home Building Council (NHBRC). The NHBRC is very different from CIDB in the sense that, the Construction Company has to prove to the NHBRC the number of houses they have built to date.

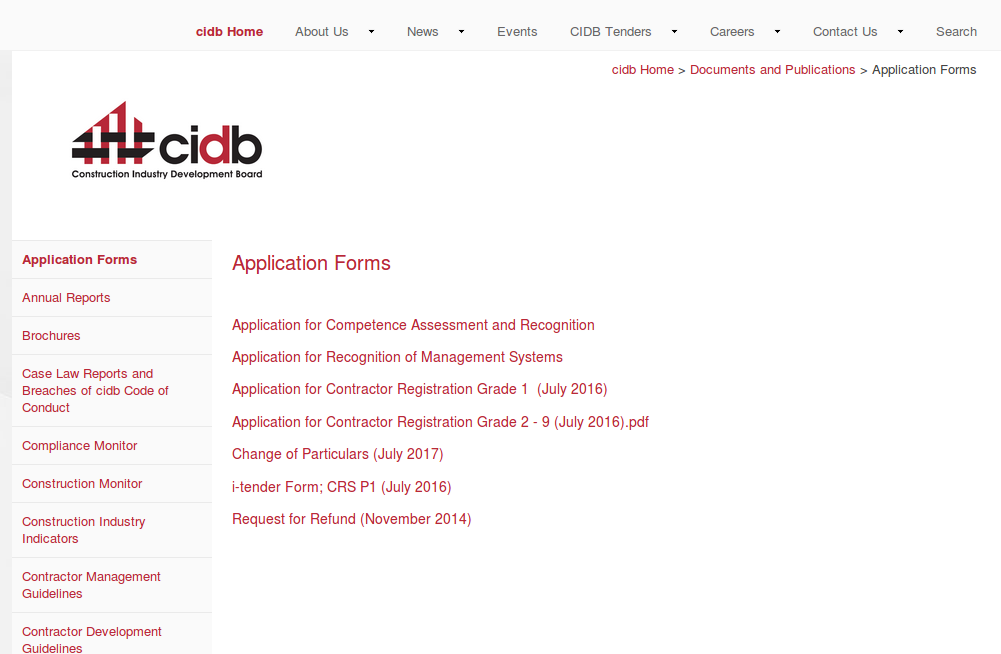

To register on CIDB, it is very simple. All you need to do is submit an application and select the applicable Grade. The construction company also needs to indicate the maximum value of work permissible in their registered grading level. There are different requirements for track record and financial capability depending on the grades and classes. The application criteria need to meet both the requirements in order to satisfy the grading assessment criteria. The CIDB Provincial Offices offer free help desk support to contractors.

The application only takes 21 working days to be registered. The 21 day waiting period is the turnaround time for applications that are complete and compliant with the requirements of the grade the contractor is applying for. Grade 1 applicants only take 48 hours to be processed and for registration to reflect on CIDB. Once the 21 working days have passed and the contractor is compliant, the contractor is then registered on the CIDB website and now have access to tender opportunities that are in their CIDB grading. In order to register you can go to the CIDB Website:

Note: Your registration expires after 3 years

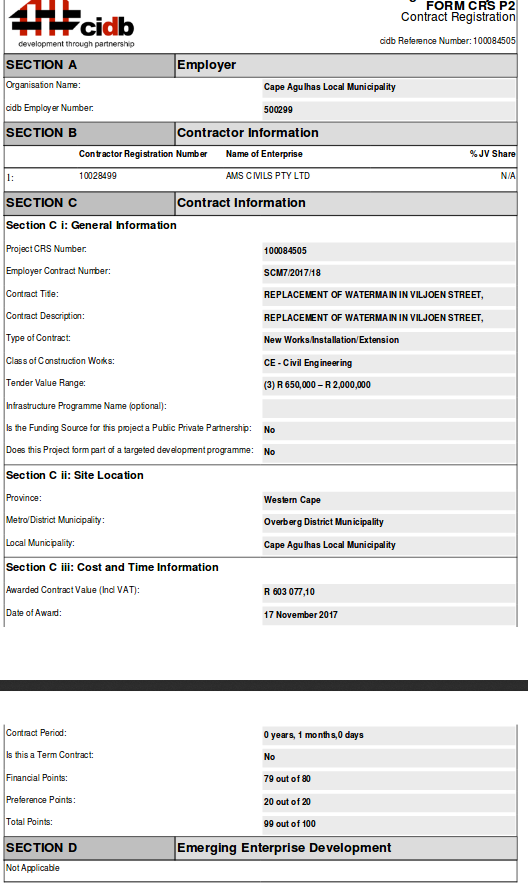

CIDB also publishes tenders that have been awarded on the system. That would mean if a contractor has applied for a specific tender, and once that tender has been awarded, one of the first places it gets published is on the CIDB website. Here, the name of the Awarded Company has listed as well as the contract value and the contract period. Below is an example of what the Award Information looks like:

Alright, so that concludes my discussion for the day. I must admit that it was quite fun sharing my information with you today. I can only hope that somewhere out there, a subscriber has learned something new today, I know I did.

Need Information or Confused about Something ?

Ask a Question

Sponsored Guide

Complete Guide to NSFAS Online Loan Application for South African Students (2025)

If you are a South African student looking to pursue higher education but are facing financial difficulties, the National Student Financial Aid Scheme (NSFAS) is one of the most accessible funding options available. NSFAS provides financial aid in the form of bursaries and loans to qualifying students at public universities and TVET colleges in South Africa.

This guide will walk you through everything you need to know about the NSFAS loan application process, from eligibility requirements to application steps and frequently asked questions.

📌 What is NSFAS?

The National Student Financial Aid Scheme (NSFAS) is a government-funded financial aid scheme aimed at helping students from low- and middle-income households to access tertiary education without the burden of upfront fees.

NSFAS offers both bursaries and income-contingent loans:

- Bursaries: For eligible students who meet academic and household income criteria (especially for TVET and university students).

- Loans: For students who do not meet all bursary criteria or who are pursuing postgraduate qualifications not funded under bursary schemes.

✅ Who Qualifies for an NSFAS Loan?

To qualify for an NSFAS loan (especially for postgraduate students or programs not funded under the bursary system), you must:

- Be a South African citizen.

- Be financially needy, with a household income of less than R350,000 per year.

- Have a valid South African ID.

- Be enrolled or accepted to study at a public university or TVET college.

- Not be funded through another bursary program that covers all expenses.

- Maintain satisfactory academic progress (returning students).

📚 Courses Funded by NSFAS

NSFAS primarily funds undergraduate qualifications, but certain postgraduate programs (e.g., PGCE, postgraduate diplomas in education, and professional courses like LLB) may be considered under the NSFAS loan scheme, not bursaries.

If you’re studying:

- Undergraduate degree or diploma: You are likely eligible for a full NSFAS bursary.

- Postgraduate study: You may qualify for a loan, depending on the course and funding availability.

📄 Required Documents for NSFAS Application

When applying, make sure you have the following documents scanned and ready:

- Certified copy of your South African ID or Smart Card.

- Parent(s) or guardian(s) ID documents.

- Proof of income (latest payslips, UIF, or affidavit if unemployed).

- Consent Form signed by your parent(s)/guardian(s) to allow NSFAS to verify income.

- Proof of registration or acceptance at a public institution.

- Academic transcripts (for continuing or postgraduate students).

🖥️ How to Apply for an NSFAS Loan Online

Step-by-Step NSFAS Online Application Process (2025)

-

Visit the NSFAS Website

Go to: https://www.nsfas.org.za

-

Create an Account

- Click on “MyNSFAS” and register your profile.

- You’ll need a valid email address and South African cellphone number.

- Choose a strong password and verify your account via email or SMS.

-

Login and Start the Application

- After registration, log in to your MyNSFAS account.

- Click on “Apply” to begin a new application.

-

Fill in Your Personal Details

- Input your ID number, name, surname, and other details exactly as they appear on your ID.

- Provide household income information and living arrangements.

-

Upload Required Documents

- Upload all supporting documents in PDF or JPEG format.

- Each document must be clear and under the size limit specified.

-

Submit Your Application

- Review your application for accuracy.

- Click “Submit” and wait for a confirmation message.

-

Track Your Application

- Log in regularly to check your application status.

- You will be notified via SMS and email at each stage of the process.

🗓️ Important NSFAS Dates (2025)

- Application Opening Date: September 1, 2025

- Application Deadline: January 31, 2026

- Appeals Period: February 2026 (if rejected)

- Disbursement: After registration and approval

Note: Dates are subject to change; always confirm on the official NSFAS website.

💸 What Does the NSFAS Loan Cover?

NSFAS funding typically includes:

- Tuition fees

- Registration fees

- Accommodation (if living away from home)

- Meals and transport

- Learning materials (e.g., textbooks)

For loans, repayment is only required once you start working and earn above a threshold (around R30,000 annually, but subject to change).

🔄 NSFAS Loan Repayment

Repayments are:

- Income-contingent – you only repay when you can afford to.

- Administered by DHET (Department of Higher Education and Training).

- Interest-bearing, but interest rates are low and favorable.

You can also apply for a partial loan conversion to a bursary if you perform well academically.

🔁 How to Appeal a Rejected NSFAS Application

If your application is rejected, you may submit an appeal via your MyNSFAS portal:

- Log into your MyNSFAS account.

- Click on “Track Funding Progress”.

- If rejected, click on “Submit Appeal”.

- Upload any missing or corrected documents.

- Provide a clear explanation or motivation.

📱 NSFAS Contact Information

- Website: https://www.nsfas.org.za

- Email: info@nsfas.org.za

- Toll-Free Number: 08000 67327 (Monday–Friday, 8 AM–5 PM)

- Twitter: @myNSFAS

- Facebook: NSFAS

📝 Final Tips Before Applying

- Apply early to avoid system overload near the deadline.

- Use your own email and cellphone number (do not use someone else’s).

- Double-check that all your documents are certified and legible.

- Keep a copy of your submission confirmation for reference.

By following this guide, you can confidently apply for NSFAS funding and move one step closer to achieving your academic and career dreams—without the burden of immediate financial pressure.